The Independent Contractor

Understanding the Florida Independent Contractor Test

Independent contractors differ markedly from employees. Employees typically work under a contract (written or oral) for a certain term; independent contractors work as they desire. Employees cannot simply cease working without consequence or else risk an action for stopping work without good cause. Independent contractors can simply stop work at any time.

Why are the distinctions between employees and independent contractors important? Because, in the vast majority of cases , the difference between the two is a company’s liability for employment-related claims. The work done by independent contractors does not create liability for any sort of employment-related claims that may arise over the work they perform. Thus, if a company had an employee with a grievance, she could pursue any number of employment-related claims against the company. However, if the company had an independent contractor with a grievance, he would be limited to pursuing claims that arise out of his contract with the company. Companies in Florida must evaluate whether the individuals performing work for them are properly classified as employees or independent contractors.

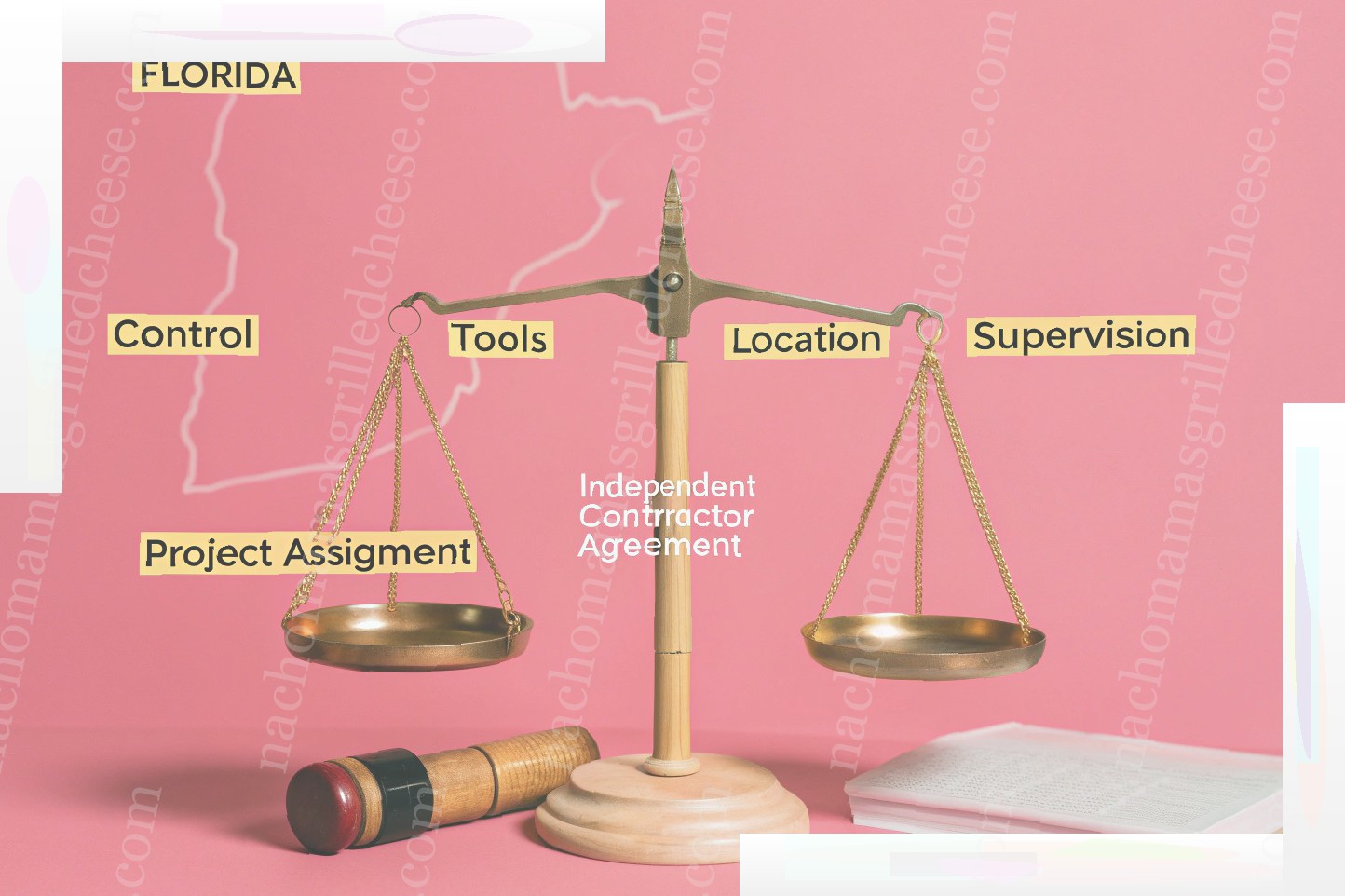

Elements of Florida’s Independent Contractor Test

The criteria used in Florida to determine whether a worker is an independent contractor are grounded in five important factors. These criteria are designed to evaluate the extent to which the hiring party has control over the work and the place of work, as well as the financial and social aspects of the relationship. The Florida courts have identified the criteria that must be considered in determining independent contractor status: 1. Degree of control exercised by the employer over the details of the work; 2. Kind of occupation, with reference to whether the work is usually done under the direction of a supervisor or is done by a specialist without supervision; 3. Source of the instrumentalities or tools; 4. Location of the work; and 5. Whether the hiring party has the right to assign additional projects to the hired party. In applying these criteria, the Florida courts have determined that the most important factor in determining independent contractor status is whether the hiring party controls the work performed. For example, in Gandy v. Reddish, 389 So. 2d 240, 241 (Fla. 1st DCA 1980), the court stated: With regard to degree of control, the amount of control retained by the employer must be a control of "detailed particulars" over the manner and means of accomplishing the result which the employer desires. . . . If the employee retains complete control over the manner and means of doing the work in accordance with his own judgment free of the employer’s intervention the basis for finding a master/servant relationship no longer exists. If the worker retains the right to control the means of accomplishing the result, there is no employee/employer relationship, and the factor is not met. For example, suppose that, in the above situation, Worker 1 had the right to hire and fire his own staff to do the work, and he effectively exercised that right. It is likely that the first factor, the degree of control exercised by the employer, would not apply, and the Florida courts would consider Worker 1 to be an independent contractor. Or an employer who did not physically own the tool and equipment used, but provided them to the worker, could lose its exemption from liability for injury to the worker (based on the other tests discussed here), if the employer essentially gave the worker unfettered discretion to use the tools and equipment and to modify it, or perform other tune-ups or repairs. As an illustration, if the tools and equipment had to be "used in accordance with standard operating procedures," then the factors of control and source of the tools would weigh against independent contractor status because the employer exercised the right to control the work. There are numerous variations to this set of criteria, and each will be resolved in the context of the situation at hand, with an eye towards whether the hiring party has the right to control the work.

Florida’s Independent Contractor Misclassification Laws

Misclassification of employees as independent contractors is no laughing matter. If you have an employee misclassified as an independent contractor, the work may be brought to your attention in the form of a lawsuit, tax audit or, in the very worst scenarios, criminal investigation. While the Alabama Department of Labor has recently announced it would no longer even investigate allegations of misclassification of construction workers, one suspects that is the exception and not the rule. Federal and state agencies can still bring their hammers down, and the penalties for being wrong can be severe.

If an employer has misclassified a worker as an independent contractor, the employer may be liable for penalties, back taxes, social security, unemployment insurance, overtime and/or other amounts. These amounts may be substantial and, depending on the length of time the worker has been misclassified, the total amount of any judgment may be eye-popping.

In addition, the IRS imposes several penalties on employers who fail to withhold or pay certain taxes. Employers may be assessed the following penalties: Finally, if more than one employer is involved in misclassification of an employee, each employer will be jointly and severally liable for the wages owed, so there is significant leverage available for tax fraud or misclassification lawsuits to be filed. If one employer did not anticipate being liable, this could be a huge shock and a big headache.

The bottom line, then, is that employers who misclassify an employee as an independent contractor can face a multitude of problems, each with substantial amounts of money at stake. Employees will be ready to seek compensation for all that was lost and denied them, including lost wages, benefits, and overtime.

Recent Case Law and Examples

Since our last post, "Understanding the Florida Independent Contractor Test", there have been some noteworthy legislative and case law developments in relation to the Florida independent contractor test. These changes point towards the possibility of a more stringent Florida independent contractor test moving forward.

Update – Florida Statutory Change Affecting Independent Contractor Agreements In June of 2023, the Florida legislature enacted a bill amending Section 475.081(4), Florida Statutes. Specifically, the bill changed the following language: If a party to an independent contractor agreement as defined in s. 475.703 is subject to discipline, revocation, or suspension under this section for engaging in conduct that constitutes a violation of this chapter or a rule adopted pursuant thereto, the commission shall prohibit recovery of compensation under the contract with respect to any services performed under the contract that would otherwise require licensure under this chapter. Ch. 2023-191, § 4, Laws of Fla. (amending Fla. Stat. § 475.081(4)). Because the Florida Mental Health Counselor Licensure Act ("MHC") already prohibited individuals who are not licensed or exempt from licensure from collecting fees for professional services, see Fla. Stat. § 491.014(1) ("No person shall directly or indirectly engage in the practice of mental health counseling… unless the person holds a valid active license"), changes to Fla. Stat. § 475.081(4) on their own will have little effect on the ability of businesses to utilize independent contractors in Florida. However, the amended language is used in the context of another piece of legislation, an amendment to the MHC. That legislation, which was signed into law on June 29, 2023, imposes additional requirements to licensure in Florida. Under this new law a Florida licensed mental health counselor "who engages in telehealth must comply with the person’s scope of practice as it exists in the jurisdiction of the patient’s location at the time services are provided." Ch. 2023-174, Laws of Fla. (amending Fla. Stat. § 491.014). Simply put, the amended language in Fla. Stat. § 475.081(4) reaffirms what the plain language of Fla. Stat. § 491.014 provides , which is that an unlicensed individual cannot collect fees for professional health services. As a result, businesses in Florida will need to ensure that their mental health providers are either licensed or otherwise exempt under Fla. Stat. § 491.014(5)(b) ("a judge of compensation claims, a judge of the Division of Administrative Hearings, a workers’ compensation mediator, a mediator certified under the Florida Rules for Certified and Family Mediators, or a mediator conducting court-ordered mediation pursuant to the Florida Rules of Civil Procedure or the Florida Rules of Family Procedure") or simply cannot be paid for the work they do.

Recent Judicial Precedent The second noteworthy update comes from a December 2022 opinion issued by the U.S. District Court for the Middle District of Florida in Boelter v. Ethos Risk Services LLC. In Boelter, the court denied a motion for summary judgment filed by defendant Ethos. Ethos had classified three Florida-based adjusters as independent contractors (and not employees) and subsequently refused to pay them sick leave or overtime wages. In denying Ethos’ motion the court pointed out that, "Ethos has not cited a single on-point case from either Florida or the Eleventh Circuit in support of its argument that Boelter’s status as a remote adjuster required an analysis under the contractual, rather than the economic, realities test." Boelter v. Ethos Risk Servs., LLC, No. 8:22-CV-179-TPB-AEP, 2022 WL 17837234 (M.D. Fla. Dec. 19, 2022). While the court’s decision does not change existing Florida law, it could indicate the potential for deciding whether a worker is an employee or an independent contractor under the economic realities test. Neither the jury instruction in Boelter nor the case’s general analysis discusses the Florida independent contractor test that we have discussed throughout this series. Despite the fact that the court’s decision is limited to the jury instruction it intends to use, the response from both parties suggests that, as the court’s opinion notes, the use of the economic realities test in Florida stands to be scrutinized in the coming months and years.

Best Practices for Florida Businesses

Actions that a business can take to ensure that its workers will be treated as independent contractors include, to the extent practical, having each worker sign a detailed independent contractor agreement. Such an agreement should explain the classification of the worker as an independent contractor and why Florida law permits that. Specifically, the independent contractor agreement should provide that: The agreement should also make clear that independent contractors are responsible for reporting their income and paying taxes. A company should keep accurate records of payments, communications, scope of work, and other matters. This may include photographs of the work performed, human resources and other related business records, and business correspondence, all of which should show a consistent course of dealing with similarly situated workers. The relationship with the worker should be evaluated periodically to ensure that it remains appropriate. This will require an overview of whether the terms of the relationship or the circumstances have changed.

Conclusion and Additional Resources

In conclusion, it is clear that the issue of independent contractor versus employee in Florida is a closely examined one. The burden is on the employer to prove independent contractor status. For purposes of unemployment compensation, the Division of Agencies/Department of Revenue Audit programs are required to follow the IRS 20 Factors test. This is true so long as the 20 Factors hold up under a closer scrutiny. Oftentimes, the IRS will ask if they can borrow from the 20 Factors test to determine the workers’ status.

As for who is an employee under the FLSA? According to the Florida Bar Journal , at times employers/members of the Association must "review practices with respect to the specific activities performed by all workers in all aspects of the business to determine whether an employment relationship may exist." The application of these principles is highly fact specific.

More information on whether an employment relationship exists is offered by the US Department of Labor’s Wage Hour Division Fact Sheets and the IRS’s guidelines on the question of whether someone is an employee under the Internal Revenue Code.

The best way to determine your business’ legal status is to consult with an attorney well versed in this area of the law. It is important to have a separate written agreement with all your workers. Seek out an attorney in your area who specializes in employment law.

Leave a Reply