Outline of Auto Repossession in NC

An overview of the car repossession process in North Carolina is important for anyone considering the legal implications of defaulting on a secured car loan. Generally, the repossession process begins when a car owner falls behind on auto loan payments. Under North Carolina law, if you have purchased a vehicle through financing or a loan agreement and fall behind on monthly payments, the lender may enact the right to reclaim it. The full scope of state law regarding the seizure and forced return of vehicles in North Carolina, however, is rather complicated.

Auto repossession in North Carolina falls under Article 9 of the Uniform Commercial Code. This article is intended to streamline the process of repossession for financial institutions such as banks and credit unions. It also governs all transactions dealing with personal property security interest, including automobile loans. Even though Article 9 governs auto repossession in North Carolina, the contractual terms of the original loan agreement are always considered the primary source of auto repossession law.

North Carolina car repossession laws state that a lender does not have to foreclose on the car . In fact, this business-like approach to repossession is specifically provided for under the law. A lender has the right to take the vehicle without securing a court order. In the eyes of the law, the lender in this situation does not violate any laws or act unlawfully.

Beyond simply taking the vehicle from the debtor’s property, a lender also has the right to sell the vehicle at private or public sale with or without notice after repossession. However, the law requires the lender to give written notice of the proposed encouraging individuals who have a specific interest in the vehicle to attend the sale. A public or private car sale requires only one notice, which may be done through a publication (such as a website, or newspaper advertisement of an auto trader magazine). For vehicle sales, the lender does not require a court order or sheriff’s involvement.

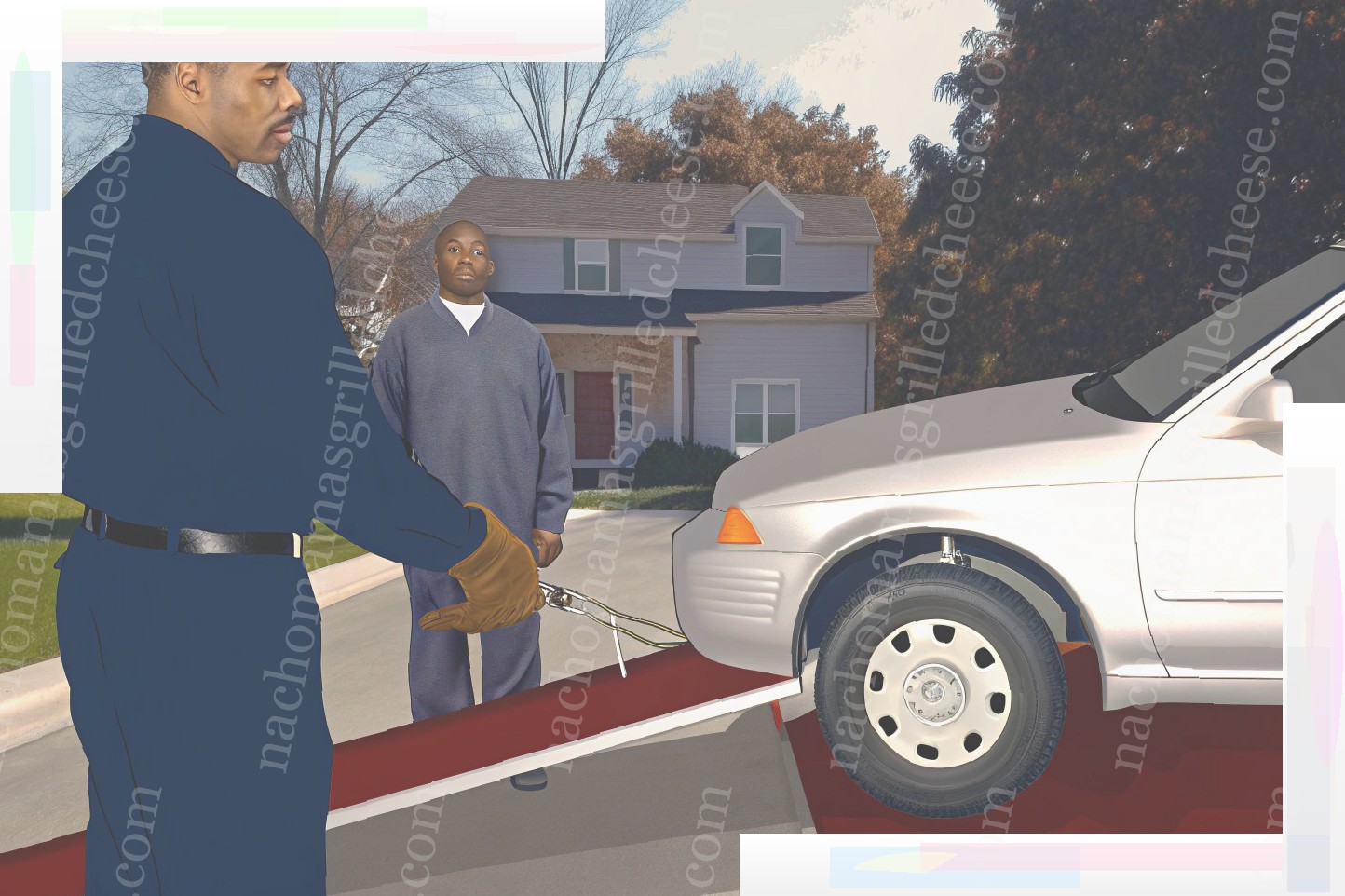

Although a lender in North Carolina can repossess any vehicle without a court order, it cannot use any force whatsoever to take the vehicle. In other words, a lender cannot break down a locked door or use physical harm to repossess a vehicle. To protect themselves from facing criminal charges, lenders may not remove someone from a given property using repossession.

How Borrowers Are Protected

The right to receive a Notice of Default: The first requirement under the North Carolina law is that the borrower receive written notice that he/she is late in making the required payments. If the payment is not received within ten (10) days after the notice is sent, the lender will have the right to repossess the vehicle. This notice can be sent electronically if you consented to receive written communication electronically.

The right to cure the default: Many underlying contracts contain a "cure provision" that allows the borrower to get up to three (3) chances to make the required payment after missing up to three (3) payments. Under North Carolina law, if your contract is silent on this issue the lender must accept a total of three (3) late payments over the life of the contract.

The right to receive notices prior to repossession and after repossession: There are many concerns and questions that borrowers have before and after the repossession. Fortunately, there are several notices that must be sent by the lender before and after repossession.

The right to have personal property returned: All personal property inside the vehicle may be retrieved from the lender. Personal property includes items such as clothing, cell phone chargers, CD’s, loose change, brief cases, laptop bags, pictures and other items that do not belong to the lender. Depending on your contract, the lender may be required to hold your personal property for a specific period of time before disposing of the property.

Duties and Restrictions on Lenders

Lenders have certain obligations and limitations when repossessing motor vehicles. First, a lender cannot break the "breach of peace," which means that the lender cannot use physical force to recover the vehicle. If the customer objects to the repossession, the lender must back off or call the Sheriff’s Department. Most of large lenders such as GMAC or Nuvell hire agents who are well trained to avoid a breach of peace. In addition, the lender cannot go outside the normal business hours to retrieve the property. Finally, a lender or its agent cannot enter any home or building without permission to repossess the vehicle.

Often, a creditor leaves a demand letter and a phone message in order to retrieve the vehicle. Nevertheless, the lender must show that it complied with its notice obligations before pursuing a lawsuit for a deficiency after a repossession.

If a lender disposes of a vehicle, it is required to furnish a list of expenses and charges incurred during the repossession and sale with the demand letter. The items in the list may include: The lender must also send a copy of the notice of intent to dispose of collateral with the demand letter. The notice must state that the lender intends to sell the collateral at public or private sales. The lender must also provide the date of the sale and an explanation of how the sale will be conducted. At the very least, the lender must describe the collateral with some specificity. A sample notice of intent is set out below.

Dear [Customer’s Name],

RE: [Vehicle Year/Make/Model/VIN]Account No. [Account Number]

This letter is to notify you that we will sell the above-referenced collateral by public or private sale. The sale will be conducted by December 13, 2006. The sale may be by bidding through an auction or other sale method. We will apply the sale proceeds to reduce the amount you owe on your account, plus the costs to repossess and sell the vehicle.

You have a right to redeem your vehicle prior to the sale by paying the amounts you owe on your account. If you do not redeem your vehicle and we later sell the vehicle, you may still be responsible to pay us any remaining balance from the sale. You have a right to request an accounting of the sale.

Enclosed is a list of the charges and expenses we have incurred while repossessing the vehicle and preparing it for sale. We can mail you a copy of the proceeds we have received from the sale within a reasonable time after the sale and if you ask, an explanation of the calculation of the proceeds we received from the sale as well.

If you wish to discuss this further please contact me or [Employee Name], [Employee Title] with [Company Name] at [Employee Phone Number] or ask for [Employee Name] who has been assigned your account with [Company Name].

Thank you.

Sincerely,

[Your Name and Title]

[Company Name]

[Company Street Address]

[City, State Zip Code]

[Company Phone Number]

What to Do When Your Car is Repo’d

If your car has been repossessed, repossession agents must give you a notice within five days of the repossession, notifying you of how you may get your car back. If you have attempted to communicate with your lender to negotiate a repayment plan to catch up on missed payments, do not assume your car will be immediately released back to you upon agreement. Repossession agents and lenders will often wait until the car reaches the auction block before they will allow it to be returned. This can be especially frustrating if you have agreed to pay the lender and have the funds readily available to do so, because the repossession agent at that point is likely charged with keeping the car until it is sold. In this situation, it is important to understand your rights as a borrower.

Sometimes it is possible to keep your car simply by paying off the overdue amount on your loan. For purposes of calculating the overdue amount, ask the lender for a payoff statement. Based on the payoff statement, make the appropriate payment arrangements with the lender. It is a good idea to use certified mail, return receipt requested, so that you can prove what payment methods you’ve used and when you’ve sent the payment to the lender. Also, make sure you have some method of payment to the lender that they will accept before offering to tender the payment.

If you have already missed a payment, the lender may proceed with repossession as permitted by the contract under North Carolina’s Uniform Commercial Code (U.C.C.) as provided under N.C.G.S § 25-9-609 or the lender may proceed with foreclosure on your vehicle. Whether a lender may pursue repossession or foreclosure depends on the exact terms of the contract. It is very important to read your contract carefully and to consult with a lawyer about your rights under the contract and with the remedies under the U.C.C.

How to Stop Car Repossession

A borrower can take several steps to potentially avoid repossession. First, as in all financial transactions, communication is very important. If the borrower is having trouble making payments, or has fallen into a financial hole that will be hard to get out of, it is advisable to contact the lender and discuss your situation with them. Depending on your circumstances, the lender may be willing to renegotiate the terms of your loan or otherwise assist you during your time of need.

Second, refinancing may also be an avenue worth exploring. Depending on the nature of your payment issues , the lender may try to renegotiate the terms of your loan, perhaps by extending the term, lowering interest or by agreeing to a new due date. Or you may seek to refinance your loan with another bank at more favorable terms.

Lastly, it is always important to consult with a lawyer. Depending on your situation, an attorney may be able to assist you in negotiations with your lender or in exploring other options like a loan modification or bankruptcy.

Again, the key point is that communication is paramount. The lender may very well be willing to work with you, but only if they are aware that there is a problem.

Car Repossession’s Effect on Credit

When a lender repossesses a motor vehicle, that negatively impacts the borrower’s credit score. That can prevent the borrower from the ability to purchse a vehicle in the future. Lenders are keenly aware that repossession tends to indicate a high risk borrower for new financing.

It is rare that an individual creates savings large enough to pay cash for the purchase of automobile. Instead, individuals obtain financing from a bank or other lender that enables them to purchase a vehicle and then pay for it over time. If a borrower ceases to make the payment on a car loan, the lender can and generally will repossess the vehicle.

The law governing the repossession process is a little complicated, so we’ll not get into the details here. But once the lender receives the car back, it usually has the option of either auctioning the vehicle off in its current condition or doing a reconditioning that can allow the car to be resold for a much higher price. Reconditioned cars typically sell for 30% to 50% more than their resale value from an auction. A bank would be foolish to dispose of a vehicle in an auction sale, where the potential buyers are price-conscious wholesale bidders who are not willing to pay as much as a retail purchaser.

When vehicles are repossessed, the bank will often assess the property before having it reconditioned, in order to determine whether there might be aftermarket products that could be sold separately for additional funds. For example, sometimes the repossession process reveals that a borrower has installed an expensive stereo or a set of expensive rims on the vehicle. In theory, the bank could remove these items and put them on the open market to obtain a sum in addition to the auction price. In practice, this process is much more trouble than it is worth. In many cases, it would not be immediately evident that high-dollar items have been installed in a car, and disassembling the vehicle to find out takes too much time and effort.

In addition, a number of states have enacted "fair sale" laws that specify that if products have been installed on a vehicle, they must be sold with the vehicle. These laws were spawned by consumer lawsuits that claimed unfair sales practices when expensive stereos and wheels were removed from vehicles and sold separately. There is additional administrative overhead associated with keeping track of which parts installed at the point of sale belong to the car and which don’t, and it is not economically feasible for most banks to keep this information on file.

Thus, the lender is already at a disadvantage with the repossessed automobile. When the vehicle is sent onto the open market, it should do reasonably well. In addition, the lender may take back another vehicle or other collateral that previously was part of the same loan agreement. The lender is on much more solid ground when it repossesses a second vehicle in the collateral pool, since it is not as likely that the borrower has invested time and money in customizing it.

All of this makes it likely that a portion of the loan amount will remain unpaid unless the borrower has voluntarily surrendered the vehicle. This is not an issue if the borrower has filed bankruptcy, as the automatic stay will prevent the lender from pursuing any recovery of the deficiency. If the borrower did not file bankruptcy, the lender must pursue a conventional collection process. This generally consists of follow-up notices and eventually a lawsuit to obtain a judgment.

If a car is repossessed, the borrower should try to find any funds possible to pay back as much as possible of the balance owed. This minimizes the impact on the borrower’s credit. In addition, there is the possibility that the lender can be convinced to accept a total payoff on the loan that is less than the full balance. There is no guarantee of this, but it is always worth the attempt for the borrower to place themselves in a better position with the bank.

Seeking Legal Counsel

While the North Carolina repossession laws are straightforward, some individuals may still need assistance understanding their rights, as well as guidance through the repossession process. Not all people facing repossession need to hire a lawyer, especially if the individual is working with the creditor outside of a legal proceeding; however, those who wish to contest an unfair repossession will need to consult with a North Carolina consumer lawyer . Many attorneys offer free initial consultations and services are usually offered on a contingency fee basis, which means if the case is lost, the client does not pay the lawyer any fees. The North Carolina Attorney General has additional information for consumers facing automobile repossession, including a guide on how to protect their rights in repossession situations. Other resources for individuals facing repossession include the Carolina Consumer Law Report, a blog authored by an attorney who focuses on consumer rights in North Carolina.

Leave a Reply